Tired of manually calculating trade returns? Discover the power of a trade return calculator!

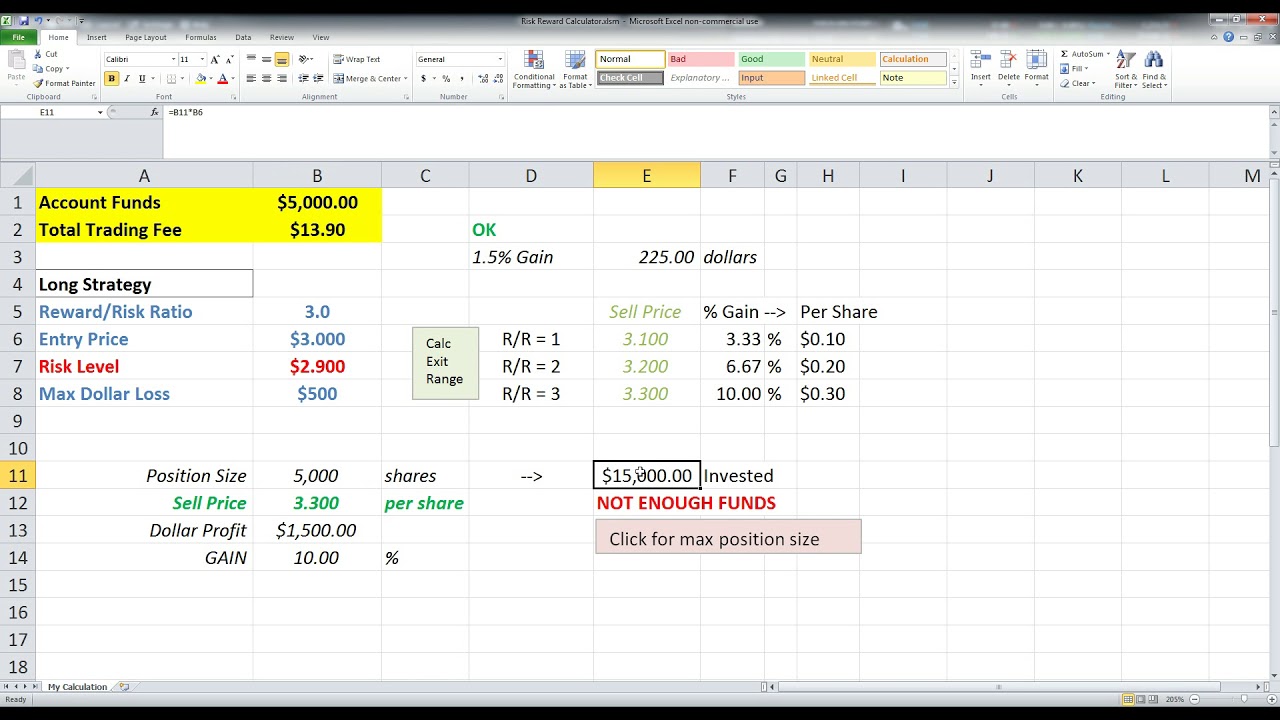

A trade return calculator is an invaluable tool for traders of all levels, enabling them to swiftly and accurately calculate the return on their trades. By inputting the trade's entry and exit prices, as well as any associated fees or commissions, the calculator instantly provides the return percentage and profit or loss amount.

The importance of a trade return calculator cannot be overstated. It streamlines the calculation process, saving traders a significant amount of time and effort. Moreover, it eliminates the risk of errors that can occur during manual calculations, ensuring greater accuracy in trade analysis.

In today's fast-paced trading environment, where every second counts, a trade return calculator provides traders with a competitive edge. It allows them to make informed decisions quickly, capitalize on market opportunities, and optimize their trading strategies for maximum profitability.

Whether you're a seasoned trader or just starting out, incorporating a trade return calculator into your trading routine can significantly enhance your trading experience. Embrace the power of technology and unlock the full potential of your trades today!

Trade Return Calculator

A trade return calculator is an essential tool for traders, providing crucial insights into the performance of their trades.

- Accuracy: Calculates returns with precision, eliminating manual errors.

- Efficiency: Saves time and effort by automating calculations.

- Simplicity: Easy-to-use interface makes it accessible to traders of all levels.

- Flexibility: Accommodates various trade types and instruments.

- Customization: Allows traders to tailor calculations to their specific needs.

- Real-time: Provides up-to-date return values based on market prices.

- Portability: Accessible from any device with internet connection.

- Decision-making: Supports informed trading decisions by quantifying trade performance.

These key aspects collectively make trade return calculators indispensable tools for traders. They enhance trading accuracy, streamline analysis, and empower traders to make optimal decisions. By leveraging the power of technology, traders can gain a competitive edge and maximize their trading potential.

1. Accuracy

Accuracy is of paramount importance in trade return calculations, as even minor errors can significantly impact decision-making and profitability.

- Precise Calculations: Trade return calculators leverage advanced algorithms to ensure precise return calculations. They eliminate the risk of human error associated with manual calculations, which can arise from factors such as fatigue, data entry mistakes, or misinterpretation of trade details.

- Eliminating Bias: Manual calculations can be prone to bias, as traders may subconsciously round numbers or make approximations. Calculators, on the other hand, provide objective and unbiased results, ensuring that traders make decisions based on accurate data.

- Consistency: Calculators apply the same set of rules and formulas to every trade, ensuring consistency in calculations. This eliminates the variability that can occur with manual calculations, where different individuals may use slightly different methods or interpretations.

- Time Savings: By automating calculations, trade return calculators save traders a considerable amount of time. This allows traders to focus on other aspects of their trading strategies, such as market analysis and risk management.

Overall, the accuracy provided by trade return calculators is crucial for traders to make informed decisions and maximize their trading performance. By eliminating manual errors and ensuring precision, calculators enhance the reliability and effectiveness of trade return analysis.

2. Efficiency

The efficiency gained through automation is a key advantage of trade return calculators, enabling traders to streamline their analysis and maximize their productivity.

- Swift Calculations: Trade return calculators perform calculations instantaneously, providing traders with immediate insights into their trade performance. This eliminates the need for manual calculations, which can be time-consuming and prone to errors.

- Multi-Trade Analysis: Calculators can process multiple trades simultaneously, allowing traders to quickly assess the performance of their entire portfolio. This comprehensive analysis would be impractical to perform manually, especially for traders with a large number of open positions.

- Scenario Analysis: Calculators enable traders to conduct scenario analysis by adjusting input parameters, such as entry and exit prices, to evaluate potential outcomes. This iterative process would be highly laborious and error-prone if done manually.

- Historical Data Analysis: Calculators can be used to analyze historical trade data, providing traders with valuable insights into their past performance and helping them identify areas for improvement. Manual analysis of historical data is a daunting task, often involving hours of tedious calculations.

By automating calculations and streamlining the analysis process, trade return calculators free up traders' time, allowing them to focus on higher-value activities, such as market research and strategy development. This efficiency is a key factor in enhancing overall trading performance and profitability.

3. Simplicity

The simplicity of trade return calculators is a crucial factor contributing to their widespread adoption and appeal among traders of all experience levels.

- Intuitive Design: Trade return calculators are designed with intuitive interfaces that make them easy to navigate and use. Traders can quickly input their trade details and obtain results without the need for extensive technical knowledge or training.

- Minimal Input: Calculators require only essential trade details, such as entry and exit prices, to perform calculations. This simplicity reduces the risk of errors and makes the process accessible to even novice traders.

- Clear Results: Calculators present results in a clear and concise manner, making it easy for traders to interpret and understand their trade performance. This clarity is crucial for making informed decisions and adjusting strategies accordingly.

- Customization: Despite their simplicity, many calculators offer customization options to cater to the specific needs of different traders. Traders can choose from a range of parameters and settings to tailor the calculator to their preferred trading style and preferences.

The simplicity of trade return calculators empowers traders to confidently analyze their trades, regardless of their experience level. This accessibility enables traders to make informed decisions, improve their trading strategies, and ultimately maximize their profitability.

4. Flexibility

The flexibility of trade return calculators is a key factor contributing to their versatility and widespread adoption. This flexibility manifests in several key aspects that enhance the calculator's usefulness and applicability to a diverse range of trading scenarios.

- Multi-Asset Support: Trade return calculators can accommodate calculations for various asset classes, including stocks, bonds, forex, commodities, and cryptocurrencies. This versatility allows traders to use a single tool to analyze their trades across different markets, simplifying their workflow and saving time.

- Trade Type Compatibility: Calculators support a wide range of trade types, including spot trades, futures, options, and CFDs. This flexibility ensures that traders can accurately calculate returns regardless of their preferred trading style or instrument.

- Multiple Account Integration: Many calculators allow traders to connect multiple trading accounts, enabling them to consolidate their trade data and analyze their overall performance across different accounts. This comprehensive view helps traders make informed decisions and identify areas for improvement in their trading strategies.

- Customizable Parameters: Calculators often provide traders with the ability to customize calculation parameters, such as commission fees, slippage, and dividend adjustments. This customization ensures that the calculator accurately reflects the specific conditions of each trade and provides precise return calculations.

The flexibility of trade return calculators empowers traders to seamlessly analyze their trades and make informed decisions, regardless of the complexity or diversity of their trading strategies. This flexibility makes trade return calculators an indispensable tool for traders seeking to maximize their profitability and optimize their trading performance.

5. Customization

Customization in trade return calculators empowers traders to adapt the calculations to their unique trading strategies and preferences. This flexibility enhances the accuracy and relevance of the results, enabling traders to make informed decisions and optimize their performance.

- Tailored Calculations: Traders can customize parameters such as commission fees, slippage, and dividend adjustments to ensure that the calculator accurately reflects their trading conditions. This customization ensures precise return calculations, eliminating discrepancies that could arise from using generic or default settings.

- Risk-Adjusted Returns: Customization allows traders to incorporate risk management strategies into their return calculations. By adjusting parameters related to stop-loss levels and risk-reward ratios, traders can assess returns in the context of their risk tolerance, leading to more informed decision-making.

- Strategy Optimization: Traders can leverage customization to fine-tune their trading strategies. By experimenting with different parameters and analyzing the corresponding return outcomes, traders can identify optimal entry and exit points, as well as refine their position sizing to maximize profitability.

The customization capabilities of trade return calculators provide traders with a powerful tool to enhance the accuracy and effectiveness of their trade analysis. By tailoring calculations to their specific needs, traders can gain a deeper understanding of their trading performance and make more informed decisions, ultimately contributing to their long-term success in the markets.

6. Real-time

The real-time capabilities of trade return calculators are a crucial aspect that sets them apart from traditional, static calculation methods.

- Dynamic Calculations: Unlike manual calculations or outdated data sources, trade return calculators provide up-to-date return values that reflect the latest market prices. This dynamic calculation ensures that traders have access to the most accurate and current information, allowing them to make informed decisions in a rapidly changing market environment.

- Immediate Insights: The real-time nature of these calculators eliminates the need for traders to wait for delayed data or refresh rates. They can instantly access return values as market prices fluctuate, enabling them to respond promptly to changing market conditions and seize opportunities.

- Risk Monitoring: The real-time updates provided by trade return calculators allow traders to continuously monitor the performance of their trades. By tracking returns in real-time, traders can identify potential risks and take appropriate action to mitigate losses or secure profits.

- Trading Strategy Optimization: The real-time capabilities of trade return calculators empower traders to refine and optimize their trading strategies. By analyzing return values in real-time, traders can identify patterns, trends, and inefficiencies in their strategies, enabling them to make adjustments and improve their overall performance.

In summary, the real-time capabilities of trade return calculators provide traders with a significant advantage in today's fast-paced and dynamic market environment. By delivering up-to-date return values, these calculators equip traders with the tools they need to make informed decisions, manage risk effectively, and optimize their trading strategies for maximum profitability.

7. Portability

The portability of trade return calculators is a key aspect that enhances their accessibility and convenience for traders, enabling them to perform calculations and analyze their trades from virtually anywhere with an internet connection.

- Mobile Accessibility: Trade return calculators are accessible on smartphones and tablets, allowing traders to analyze their trades and make informed decisions while on the go. This portability is particularly valuable for traders who need to monitor their trades or react to market changes in real-time, regardless of their location.

- Cross-Platform Compatibility: Many trade return calculators are web-based or offer mobile applications, making them compatible with various devices and operating systems. This cross-platform compatibility ensures that traders can access and use the calculator seamlessly, regardless of their device preferences.

- Remote Trading: The portability of trade return calculators facilitates remote trading, enabling traders to manage their trades and analyze their performance from anywhere with an internet connection. This flexibility is particularly beneficial for traders who travel frequently or work from remote locations.

- Cloud-Based Storage: Some trade return calculators offer cloud-based storage, allowing traders to access their calculations and data from multiple devices. This feature ensures that traders have a centralized repository for their trade analysis, eliminating the need for manual data transfer or storage on individual devices.

Overall, the portability of trade return calculators empowers traders with the convenience and flexibility to analyze their trades and make informed decisions from any location with an internet connection. This portability enhances the accessibility and effectiveness of trade return calculators, enabling traders to stay connected to their trades and optimize their performance.

8. Decision-making

Trade return calculators play a critical role in supporting informed decision-making for traders by quantifying the performance of their trades. This quantification enables traders to make objective assessments of their trading strategies, identify areas for improvement, and optimize their overall performance.

- Accurate Calculations: Trade return calculators provide precise calculations of trade returns, eliminating the risk of manual errors and ensuring that traders have a clear understanding of the profitability of their trades.

- Real-time Analysis: Many trade return calculators offer real-time analysis, allowing traders to monitor the performance of their trades as market conditions change. This real-time feedback enables traders to make timely adjustments to their strategies and capitalize on market opportunities.

- Scenario Analysis: Trade return calculators allow traders to conduct scenario analysis by adjusting input parameters, such as entry and exit prices. This iterative process helps traders evaluate potential outcomes and make informed decisions based on various market conditions.

- Historical Data Analysis: Trade return calculators can be used to analyze historical trade data, providing traders with valuable insights into their past performance. This analysis helps traders identify patterns, trends, and areas for improvement in their trading strategies.

By quantifying trade performance and providing traders with a comprehensive view of their trading activities, trade return calculators empower traders to make informed decisions, improve their trading strategies, and ultimately maximize their profitability.

Frequently Asked Questions about Trade Return Calculators

Trade return calculators are valuable tools for traders, but they can also be daunting to those who are new to using them. This FAQ section aims to address some of the most common questions and misconceptions surrounding trade return calculators.

Question 1: What is a trade return calculator?

A trade return calculator is a tool that helps traders calculate the return on their trades. This involves using the formula:(Selling Price - Buying Price + / - Fees and Commissions) / Buying Price * 100It takes into account factors such as the entry and exit prices of the trade, as well as any associated fees or commissions. The result is expressed as a percentage, indicating the profit or loss incurred on the trade.

Question 2: Why should I use a trade return calculator?

There are several benefits to using a trade return calculator:- Accuracy: Calculators eliminate the risk of manual errors, ensuring precise return calculations.- Efficiency: They save time and effort by automating calculations, freeing up traders to focus on other aspects of their trading strategies.- Simplicity: Calculators are designed with intuitive interfaces, making them accessible to traders of all experience levels.- Flexibility: They accommodate various trade types and instruments, providing traders with a comprehensive analysis of their performance.- Customization: Many calculators offer customizable parameters, allowing traders to tailor calculations to their specific needs.- Real-time: Some calculators provide real-time updates, reflecting the latest market prices for up-to-date return values.- Portability: Web-based and mobile applications make calculators accessible from anywhere with an internet connection, enhancing convenience and flexibility.- Decision-making: By quantifying trade performance, calculators support informed decision-making, helping traders refine their trading strategies and maximize profitability.

Question 3: How do I use a trade return calculator?

Using a trade return calculator is straightforward:- Gather the necessary information, including the entry and exit prices of the trade, as well as any associated fees or commissions.- Input the values into the calculator's designated fields.- The calculator will automatically compute the return and display the result as a percentage, indicating profit or loss.

Question 4: Are trade return calculators accurate?

The accuracy of trade return calculators depends on the accuracy of the input data. If the input information is correct, the calculator will provide precise return calculations. However, it is important to note that calculators cannot predict future returns or guarantee profitability.

Question 5: What are some limitations of trade return calculators?

While trade return calculators are useful tools, they do have some limitations:- Historical data: Calculators rely on historical data to provide insights, but past performance is not necessarily indicative of future results.- Market volatility: Calculators cannot account for unexpected market fluctuations that may impact trade returns.- Emotional factors: Calculators cannot account for emotional factors that may influence trading decisions, such as fear or greed.

In summary, trade return calculators are valuable tools that can assist traders in quantifying their trade performance and making informed decisions. By understanding the capabilities and limitations of these calculators, traders can effectively incorporate them into their trading strategies.

Transitioning to the next article section:To further enhance your trading knowledge and skills, explore the following resources:

Conclusion

Trade return calculators have emerged as indispensable tools for traders, providing accurate and efficient calculations of trade performance. Their simplicity, flexibility, and customization options make them accessible and adaptable to various trading strategies.

By leveraging the capabilities of trade return calculators, traders can make informed decisions, identify areas for improvement, and optimize their overall profitability. These calculators provide traders with a competitive edge in today's fast-paced and dynamic market environment.