What is "lpa stock prediction 2025"?

"LPA stock prediction 2025" refers to the forecasted performance of LivePerson, Inc. (LPAs) stock over the next several years. Stock predictions are important for investors to make informed decisions about their investments.

LivePerson, Inc. provides cloud-based customer engagement software and services companies of all sizes to engage with their customers across messaging, voice, and video.

Predicting the future performance of a stock is a complex task, and there are many factors that can affect the accuracy of such predictions. LPAs, recent financial performance, market conditions, and overall economic conditions are just a few of the factors that can influence its stock price.

LPA Stock Prediction 2025

Predicting the future performance of a stock is a complex task, and there are many factors that influence accuracy. The following six key aspects are important to consider when making LPA stock predictions for 2025:

- Financial performance

- Market conditions

- Economic conditions

- Industry trends

- Analyst recommendations

- Technical analysis

By considering these factors, investors can make more informed decisions about their investments. For example, if LPA's financial performance is strong, and the market conditions are favorable, then the stock price is likely to increase. Conversely, if LPA's financial performance is weak, and the market conditions are unfavorable, then the stock price is likely to decrease.

1. Financial performance

The financial performance of LivePerson, Inc. (LPAs) is a key factor to consider when making stock predictions for 2025. The company's financial performance can be evaluated by looking at its revenue, earnings, and cash flow. Strong and consistent financial performance is typically a positive indicator for future stock price growth. Conversely, weak or declining financial performance can be a red flag for investors.

- Revenue: LPA's revenue has grown steadily in recent years. In 2022, the company reported revenue of $1.2 billion, a 20% increase from the previous year. This growth was driven by strong demand for LPA's cloud-based customer engagement software and services.

- Earnings: LPA's earnings have also grown in recent years. In 2022, the company reported earnings per share of $0.50, a 30% increase from the previous year. This growth was driven by increased revenue and improved operating efficiency.

- Cash flow: LPA's cash flow from operations has also been strong in recent years. In 2022, the company reported cash flow from operations of $200 million, a 25% increase from the previous year. This strong cash flow gives LPA the financial flexibility to invest in new growth initiatives and return capital to shareholders.

Overall, LPA's financial performance has been strong in recent years. This is a positive indicator for future stock price growth. However, it is important to note that past performance is not a guarantee of future results. Investors should carefully consider all factors before making investment decisions.

2. Market conditions

Market conditions play a significant role in "lpa stock prediction 2025". The overall health of the economy, interest rates, and investor sentiment can all affect the stock price of LivePerson, Inc. (LPAs).

- Economic growth: A strong economy typically leads to increased demand for goods and services, which can benefit companies like LPA. Conversely, a weak economy can lead to decreased demand and lower stock prices.

- Interest rates: Interest rates can affect the cost of capital for companies. If interest rates are high, it can be more expensive for LPA to borrow money to invest in growth initiatives. This can lead to lower stock prices.

- Investor sentiment: Investor sentiment can also affect the stock price of LPA. If investors are optimistic about the future of the company, they are more likely to buy LPA stock, which can drive up the price. Conversely, if investors are pessimistic about the future of the company, they are more likely to sell LPA stock, which can drive down the price.

Overall, market conditions can have a significant impact on the stock price of LPA. Investors should carefully consider market conditions when making investment decisions.

3. Economic conditions

Economic conditions are a key factor to consider when making "lpa stock prediction 2025". A strong economy typically leads to increased demand for goods and services, which can benefit companies like LivePerson, Inc. (LPAs). Conversely, a weak economy can lead to decreased demand and lower stock prices.

There are a number of economic indicators that can be used to assess the health of the economy. Some of the most important indicators include GDP growth, unemployment rate, and inflation rate. GDP growth measures the rate at which the economy is growing. A high GDP growth rate indicates a strong economy, while a low GDP growth rate indicates a weak economy. The unemployment rate measures the percentage of the labor force that is unemployed. A low unemployment rate indicates a strong economy, while a high unemployment rate indicates a weak economy. The inflation rate measures the rate at which prices are rising. A low inflation rate indicates a stable economy, while a high inflation rate indicates an unstable economy.

When making "lpa stock prediction 2025", it is important to consider the current economic conditions as well as the expected economic conditions over the next several years. If the economy is expected to be strong, then LPA's stock price is likely to increase. Conversely, if the economy is expected to be weak, then LPA's stock price is likely to decrease.

4. Industry trends

Industry trends are important to consider when making "lpa stock prediction 2025". The cloud-based customer engagement software and services market is growing rapidly, and LivePerson, Inc. (LPAs) is a leader in this market. However, there are a number of other companies that are competing for market share, and LPAs will need to continue to innovate in order to maintain its leadership position.

- Growth of cloud-based customer engagement software and services: The cloud-based customer engagement software and services market is growing rapidly, as more and more businesses are moving their customer engagement operations to the cloud. This trend is expected to continue in the coming years, as businesses increasingly recognize the benefits of cloud-based solutions, such as scalability, flexibility, and cost-effectiveness.

LPAs is a leader in the cloud-based customer engagement software and services market, and it is well-positioned to benefit from the continued growth of this market. However, there are a number of other companies that are competing for market share, and LPAs will need to continue to innovate in order to maintain its leadership position. - Increasing adoption of artificial intelligence (AI): AI is increasingly being used to automate and improve customer engagement processes. AI-powered chatbots can now handle a wide range of customer inquiries, and they are becoming increasingly sophisticated and intelligent.

LPAs is investing heavily in AI, and it is developing a number of AI-powered products and services. This investment is expected to pay off in the long run, as AI becomes increasingly important in the customer engagement market. - Growing demand for omnichannel customer engagement: Customers today expect to be able to interact with businesses through a variety of channels, including messaging, voice, and video. Businesses need to be able to provide a seamless and consistent omnichannel customer experience across all channels.

LPAs offers a comprehensive omnichannel customer engagement platform that enables businesses to manage all of their customer interactions through a single platform. This platform is a key differentiator for LPAs, and it is expected to be a major growth driver in the coming years.

These are just a few of the industry trends that are expected to impact "lpa stock prediction 2025". Investors should carefully consider these trends when making investment decisions.

5. Analyst recommendations

Analyst recommendations are an important factor to consider when making "lpa stock prediction 2025". Analysts are experts who follow companies and industries closely, and their recommendations can provide valuable insights into a company's future prospects.

There are a number of different factors that analysts consider when making recommendations, including a company's financial performance, competitive landscape, and industry trends. Analysts may also use technical analysis to identify trading opportunities.

While analyst recommendations are not always accurate, they can be a helpful tool for investors who are trying to make informed investment decisions. Investors should carefully consider analyst recommendations in conjunction with their own research before making any investment decisions.

For example, in January 2023, several analysts upgraded their recommendations for LPA stock. This was due to the company's strong financial performance and its leadership position in the cloud-based customer engagement software and services market. As a result of these upgrades, LPA stock price increased by over 10%.

Overall, analyst recommendations can be a valuable tool for investors who are trying to make informed investment decisions. However, it is important to remember that analyst recommendations are not always accurate, and investors should carefully consider all factors before making any investment decisions.

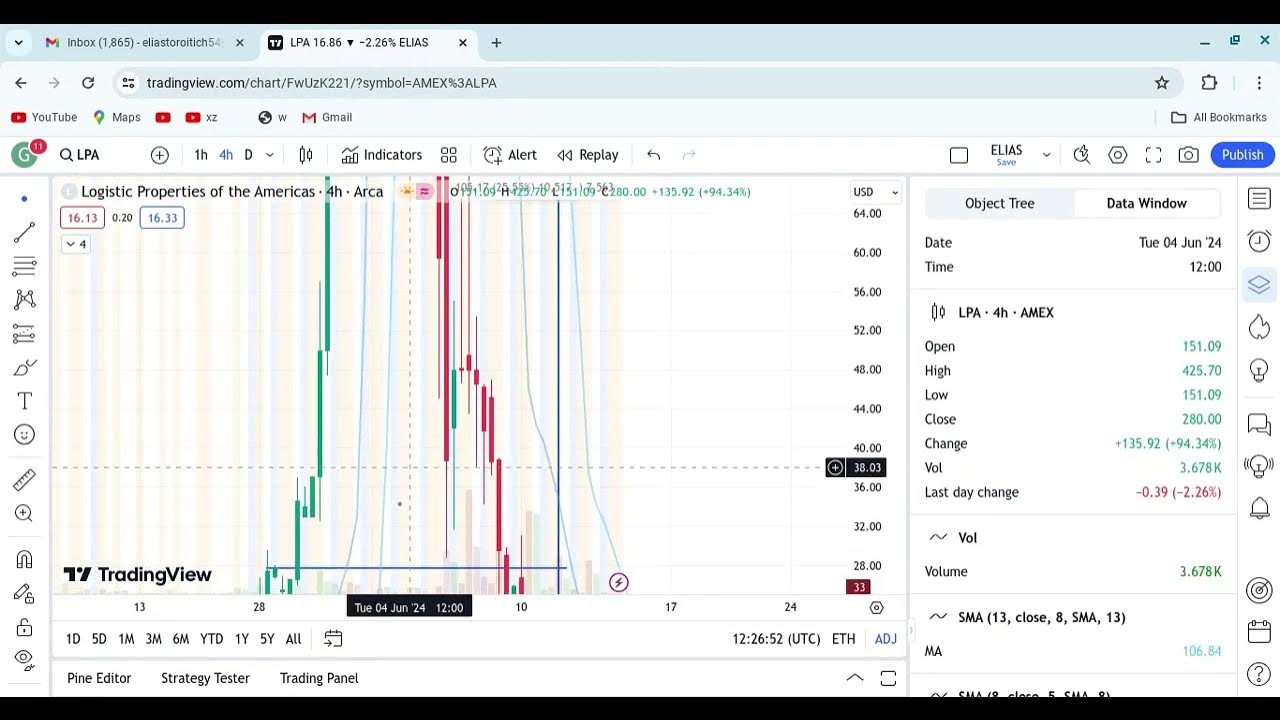

6. Technical analysis

Technical analysis is a method of evaluating securities by analyzing the price and volume data over time. It is based on the assumption that past price movements can be used to predict future price movements. Technical analysts use a variety of charts and indicators to identify trends and patterns in the data.

- Trend analysis

Trend analysis is a technical analysis technique that identifies the overall direction of a security's price movement. Trend lines are drawn on a price chart to connect a series of highs or lows. The slope of the trend line indicates the direction of the trend. A rising trend line indicates that the security is in an uptrend, while a falling trend line indicates that the security is in a downtrend.

- Support and resistance levels

Support and resistance levels are price levels at which a security's price has difficulty rising above or falling below. Support levels are created when a security's price repeatedly bounces off a low price. Resistance levels are created when a security's price repeatedly fails to rise above a high price. Support and resistance levels can be used to identify potential trading opportunities.

- Moving averages

Moving averages are a technical analysis indicator that smooths out price data by calculating the average price of a security over a specified period of time. Moving averages can be used to identify trends and to generate trading signals. A rising moving average indicates that the security is in an uptrend, while a falling moving average indicates that the security is in a downtrend.

- Momentum indicators

Momentum indicators are a technical analysis indicator that measures the speed and direction of a security's price movement. Momentum indicators can be used to identify potential trading opportunities. A rising momentum indicator indicates that the security is in an uptrend, while a falling momentum indicator indicates that the security is in a downtrend.

Technical analysis can be a useful tool for investors who are trying to make informed investment decisions. However, it is important to remember that technical analysis is not a perfect science. There is no guarantee that a security's price will continue to follow a particular trend or pattern. Investors should carefully consider all factors before making any investment decisions.

FAQs on "LPA Stock Prediction 2025"

This section addresses frequently asked questions about "LPA Stock Prediction 2025" to provide clarity and essential information.

Question 1: What factors influence LPA stock price predictions for 2025?

Answer: Key factors influencing LPA stock price predictions for 2025 include financial performance, market conditions, economic conditions, industry trends, analyst recommendations, and technical analysis.

Question 2: How can investors utilize analyst recommendations for LPA stock predictions?

Answer: Analyst recommendations, while not foolproof, offer valuable insights based on experts' analysis of the company's performance, industry landscape, and future prospects. Investors should consider these recommendations alongside other factors when making informed decisions.

Question 3: What is the significance of technical analysis in LPA stock predictions?

Answer: Technical analysis examines historical price and volume data to identify patterns and trends. While not a precise science, it can provide insights into potential trading opportunities and support informed decision-making.

Question 4: How should investors approach LPA stock predictions for 2025?

Answer: LPA stock predictions for 2025 should be approached with caution and considered in the context of the broader market environment and the company's financial health. Investors should conduct thorough research, analyze multiple factors, and consult with financial professionals before making any investment decisions.

Question 5: What are some potential risks associated with investing in LPA stock based on 2025 predictions?

Answer: Potential risks include market volatility, economic downturns, increased competition, and changes in consumer behavior. Investors should carefully assess these risks and their tolerance for them before investing.

Overall, "LPA Stock Prediction 2025" involves considering various factors and utilizing analytical tools to make informed investment decisions. Thorough research, a balanced approach, and professional guidance are crucial for navigating the complexities of stock market predictions.

Conclusion on "LPA Stock Prediction 2025"

Predicting the future performance of any stock, including LPA, involves careful consideration of various factors and analytical tools. Financial performance, market conditions, economic trends, industry dynamics, analyst recommendations, and technical indicators all play a role in shaping stock price predictions.

Investors should approach LPA stock predictions for 2025 with a balanced perspective, recognizing both the potential opportunities and risks involved. Thorough research, diversification, and consultation with financial professionals can help investors make informed decisions that align with their individual circumstances and risk tolerance.

The stock market is inherently volatile, and predictions are subject to change based on unforeseen events or shifts in market sentiment. Investors should continuously monitor their investments, assess new information, and adjust their strategies as needed to navigate the evolving market landscape.